Why Am I Always Broke?

Do you ever ask yourself this question? Why the heck am I always broke? I work hard, I have a good job, and I don't buy extravagant things like Joe Schmo. Other families are always going on trips and doing fun things and I stay home, don't eat out and take my family on camping trips instead of flying to Disney. I live in a modest house; I drive a modest vehicle. I haven't bought a new outfit in 2 years. Why, oh why, am I always broke? I personally ask myself these questions ALL THE TIME. The end of the month comes and my checking account drops to zero or even worse, negative. And if you don't have a savings account then you are really in trouble. Hello credit! So what do you do. When you find yourself in this situation the first step is the hardest.

I want to say a disclaimer first. This stuff is really hard to follow through on. I get that. I am living it all the time. And add a spouse and kids and it can get really hairy. But if you take these suggestions and do them for 1 month and are diligent with them, at the end of the month you will know EXACTLY where your money is going. And you might be surprised. You can do this. And get your spouse on board.

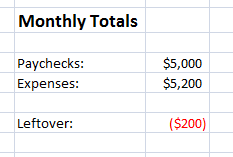

The Numbers (A 'Lost' Reference)

There are three super important numbers that every person should know. How much income do I make each month, how much do I spend and what is left over? Without knowing your finances can literally be a guessing game. Does your income fluctuate between seasons? Check out Tim's post on Seasonally Influenced Income.

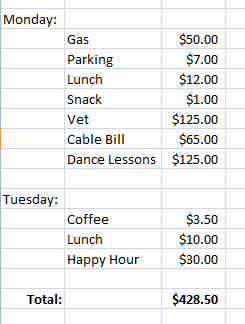

Where Does It All Go

For one month write down every single penny you spend. Whether it be a $1.00 at the vending maching or $1.50 on a pop at the gas station. Include cash purchases and debit/credit purchases. There are a million and one ways to do this. I like the good old fashioned piece of paper and pen because I can keep it in my purse. But I do recommend at the end of the day sitting down and typing everything into and excel spreadsheet. That way you can keep an easy to read record. My one word of advice...Don't Cheat! Be honest with yourself so you can get an accurate picture. I remember a time when I tried to keep track of my expenses and lied about what I spent. Who is that going to help!

It All Adds Up

The month is done. Add up the total. Are you surprised? I know I was. I always boast and say that my husband and I never eat out. Well...that is only partially true. We don't go to sit down restaurants anymore because we have 2 very loud young children but we do order food to-go at least once a week. And go through a drive-thru every once in a while. And of course there are lunches at work and a Starbucks in the afternoon. Doing this exercise was really eye opening for me.

Another expense I was surprised about was money I spent on clothes. I tend to buy most of my kids clothes used at garage sales and I have always been very proud of myself for saving money and not buying things new. Well, after the month was over I realized I was taking $50.00 minimum out of our account every weekend in the summer to go to sales. Yes, I was saving money by spending less per item but the bottom line is that I really don't need the clothes right now.

Another expense that surprised me was gas station expenses. I tend to stop and buy a coffee at Holiday on the way to daycare. I'm always proud that I am not buying a $5.00 coffee. But the truth is it still adds up. I should really wait till I get home and make coffee.

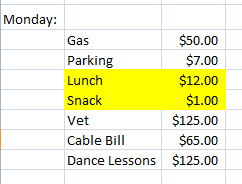

Dump Your Expenses

Next, I recommend grabbing a highlighter and going through your expenses one by one. Highlight what you can cut out. Maybe it's a coffee one day and drinks with friends another day. Add up all of the unnecessary expenses. This might shock you. I found $250.00 EXTRA in my budget. That is so much money!

This Is Just The Start

I honestly can't tell you how much better you will feel once you actually know where your money is going. I promise you the anxiety will get better. Even just knowing WHY you are broke is a start. Take the first step. You can do it. And once you know then you can start to fix it. Give us a call at 888.577.2227 or visit our website to get started. Our counselors can help you make a plan to build a life without debt.

By Kate Swenson